Filed by the Registrant

Filed by the Registrant

Filed by a party other than the Registrant

Filed by a party other than the RegistrantUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(A) of

the Securities

Exchange Act of 1934 (Amendment No. )

|  Filed by the Registrant Filed by the Registrant |  |  Filed by a party other than the Registrant Filed by a party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14A-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material Pursuant to §240.14a-12 |

ALPHABET INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of | ||

| No fee required. | |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which the transaction applies: | |

| (2) | Aggregate number of securities to which the transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| Fee paid previously with preliminary materials. | |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount previously paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

Notice of 2019 Annual Meetingof Stockholders and Proxy Statement

| DEAR STOCKHOLDERS |  1600 Amphitheatre Parkway |

1600 Amphitheatre ParkwayMountain View, California 94043(650) 253-0000

April 30, 2019

Dear Stockholders:

We are pleased to invite you to attendparticipate in our 20192021 Annual Meeting of Stockholders (Annual Meeting) to be held on Wednesday, June 19, 20192, 2021 at 9:00 a.m., local time, at our Moffett Place Event Center (Building MP7) at 1160 Bordeaux Drive, Sunnyvale, California 94089. Please note the new location. For your convenience, we are also pleased to offerPacific Time. We have adopted a live webcast ofvirtual format for our Annual Meeting to provide a consistent experience to all stockholders regardless of location.

Alphabet stockholders of Class A or Class B common stock (or their proxy holders) as of the close of business on the record date, April 6, 2021 (Record Date), can participate in and vote at https://our Annual Meeting by visiting www. virtualshareholdermeeting.com/GOOGL21 and entering the 16-digit control number included in your Notice of Internet Availability of Proxy Materials (Notice), voting instruction form, or proxy card. All others may view the Annual Meeting through our Investor Relations YouTube channel at www.youtube.com/c/AlphabetIR.

DetailsFurther details regarding admission toparticipation in the Annual Meeting and the business to be conducted are described in the Notice of Internet Availability of Proxy Materials (Notice) you received in the mail and in this proxy statement. We have also made available a copy of our 20182020 Annual Report to Stockholders (Annual Report) with this proxy statement. We encourage you to read our Annual Report. It includes our audited financial statements and provides information about our business.

We have elected to provide access to our proxy materials over the Internet under the U.S. Securities and Exchange Commission’s “notice and access” rules. We are constantly focused on improving the ways people connect with information, and believe that providing our proxy materials over the Internet increases the ability of our stockholders to connect with the information they need, while reducing the environmental impact of our Annual Meeting. If you want more information, please see the Questions and Answers section of this proxy statement or visit the 20192021 Annual Meeting section of our Investor Relations website at www.abc.xyz/investor.https://abc.xyz/investor/other/annual-meeting/.

Your vote is important. Whether or not you plan to attendparticipate in the Annual Meeting, we hope you will vote as soon as possible. You may vote over the Internet, as well as by telephone, or, if you requested to receive printed proxy materials, by mailing a proxy or voting instruction form. Please review the instructions on each of your voting options described in this proxy statement, as well as in the Notice you received in the mail.

Also, please let us know if you plan to attend our Annual Meeting by marking the appropriate box on the enclosed proxy card, if you requested to receive printed proxy materials, or, if you vote by telephone or over the Internet, by indicating your plans when prompted.

Thank you for your ongoing support of, and continued interest in Alphabet. We hope you can join us in person at our Annual Meeting or watch the live webcast.

Sincerely,

|   |  |  |

| APRIL 23, 2021 |

|

|

Dear Fellow Stockholders,

When I last wrote to you all as Chair of the Alphabet Board last year, we had just begun to grasp the profound reality of what life would be like during the COVID-19 pandemic. I stressed how the company we are all invested in was stepping up to a truly global challenge – to help people everywhere stay informed, stay connected, stay in business, and, most important, stay healthy, while also helping to sustain and support our workforce.

Twelve months on, we’re still feeling the pandemic’s effects and will for some time. Despite the challenges, Alphabet has responded in a way we can all be proud of. In addition to the products and services that helped people and businesses, we provided significant funding to support the global COVID-19 response, including distance learning, and economic relief and recovery. We worked in partnership with the technology and medical communities to help with exposure notifications and provide authoritative information about COVID-19 and vaccination to millions of our users.

Looking inward, we’ve also made sure to support our most important resource – our people – as they navigate a new reality. As our offices shifted to a work-from-home posture, we made sure that our hourly workers who were affected by reduced work schedules were compensated for the time they would have worked, along with an emergency sick leave fund. For full-time employees, we expanded our carer’s leave program for those dealing with increased caregiving responsibilities. We’ve broadened our mental healthcare offerings, and we’ve rolled out at-home viral testing kits so that employees can monitor their health and help slow the spread of COVID-19 in their communities.

Throughout the year, we also recognized our responsibility to address racial equity issues with the same focus and urgency. We continued the work of creating the most diverse and inclusive workforce possible – to add more diverse employees, and even more importantly, support them once they get here. This summer, in the wake of widespread racial unrest in the U.S., and in partnership with Black employees, we made new commitments to do our part to increase racial equity, within the company and in the wider world in which we operate and live. Among other commitments, we set a goal to improve leadership representation of underrepresented groups by 30 percent by 2025. We also announced a $175 million+ economic opportunity package to support Black business owners, startup founders, job seekers and developers, in addition to YouTube’s $100 million fund to amplify Black creators and artists.

Beyond that, to ensure a fair workplace, this year the Board agreed on a series of industry-leading principles and improvements that incorporated input from both employees and stockholders, including the creation of a new Diversity, Equity, and Inclusion (DEI) Advisory Council, which comprises internal senior executives and external DEI experts. The Board also now reviews the effectiveness of our sexual harassment and retaliation prevention programs, and proposed changes, on a quarterly basis.

Another area of emphasis and bold commitment by us this past year was in sustainability. Building a sustainable company and contributing to a sustainable future has always been core to our values, a central element of our corporate DNA. We’ve always been a leader in sustainability efforts, and now we are making the most ambitious commitments we have ever made to fighting climate change and supporting the generation of clean energy. In September we announced that, over the next decade, we’re committed to:

| • | Becoming the first major company to operate on carbon-free energy 24 hours a day, seven days a week in all of our data centers and campuses worldwide. |

| • | Investing in manufacturing regions to enable 5 gigawatts of new carbon-free energy, which we expect to spur more than $5 billion in clean energy investments. |

| • | Helping more than 500 cities and local governments reduce an aggregate of 1 gigaton of carbon emissions annually. |

To support both our ongoing efforts and new projects that are environmentally or socially responsible, in 2020 we issued $5.75 billion in sustainability bonds, the largest sustainability or green bond by any company in history. The proceeds from these bonds will fund these efforts and allow investors to join us in building a more sustainable future. We believe that these investments benefit our communities, employees and stakeholders, and are an important means of creating value over the long term.

Finally, we are committed to a governance structure that promotes long-term stockholder value creation and accountability. This past year, the Board implemented a majority voting standard for elections of directors. We’ve also amended the charter of our Audit Committee, now the Audit and Compliance Committee, giving it increased oversight on matters related to strategy and financial reporting, competition, civil and human rights, and sustainability, in addition to its existing oversight responsibilities around data privacy and security. Importantly, we will further focus on driving shared accountability amongst our leadership team for behaviors and outcomes that create lasting, meaningful change. In 2022, we intend to introduce a bonus program for members of Google’s senior executive team that will be determined in part by performance supporting the environmental, social, and governance (ESG) goals that have long been a key part of Alphabet and Google’s work.

By no means is this summary of our work exhaustive. The company has made significant progress in continuing to build products, especially in AI, ethically and responsibly; ensuring the privacy and security of our users; supporting quality publishers and promoting quality content online; and doing it all in a landscape where we compete fairly and give our users the most helpful services that we can. Updates to Meet, Search, Maps and many of our other core products over the past year have helped users navigate uncertainty while staying connected and informed. We’ll continue to make our products even more helpful to people who are working, learning, and gathering together remotely, and businesses working to keep their doors open.

The Board has worked closely with Alphabet’s leadership to build the company we all want, and that our users deserve. The Board is grateful for the faith you have placed in us to lead your company out of the rough parts of the last year, into an exciting future – and throughout the years to come. We hope we have repaid that faith with a company that continues to make you as proud as it does us. Thank you for all that you do. The Board looks forward to working with you all in the better days that surely lie ahead.

Very truly yours,

| |

| JOHN L. HENNESSY | |

| CHAIR OF THE BOARD OF | |

| DIRECTORS |

LETTER FROM THE CHAIRMAN OF THE BOARD OF DIRECTORS

Dear Fellow Stockholders,

I’ve been on the Google, then Alphabet, Board for 15 years. I’ve had the privilege to work closely with Sergey, Larry, Sundar, and an evolving and diverse group of directors. And last year I had the honor of becoming Alphabet’s Chairman.

The companies that comprise Alphabet continue to build technologies that improve the lives of people everywhere. Google now has eight products serving over a billion people each, a reflection of the truly global adoption of its products and services, and a tribute to a lot of hard work and commitment from our employees. It’s also partnering deeply to help enterprises transition to cloud computing. Already on the road in Phoenix, Arizona, Waymo is working to ensure that people can safely hail rides from self-driving cars. Wing has just received FAA approval to start delivering goods by drone. And we are making progress on a number of other important areas from health to artificial intelligence.

Of course, as the benefits of technology spread to many more people, we know that we have a deep and growing responsibility to ensure that technology benefits society as a whole. We’re committed to supporting our users, employees, and shareholders, by always acting responsibly, inclusively, and fairly.

Our Board takes seriously its leadership and oversight role in these areas. Recent years have seen broader discussions around the role of companies in promoting diversity and sustainability. These are issues we are deeply committed to as a Board and as a company.

Our Board receives frequent updates from management, monitors progress, scrutinizes the company’s policies, and carefully considers these complex issues with the attention and focus that they warrant. In recent years, we’ve tackled these issues in important and meaningful ways. Just a few examples:

These important topics will continue to evolve, and so will our approaches to them. I can promise that we will always move forward with the focus and attention that these challenges demand.

On behalf of the Board of Directors, we look forward to working with you, and serving you, in the years to come. Thank you for your support and feedback, and I look forward to seeing you at the Stockholders meeting on June 19th.

John L. Hennessy

Chairman of the Board of Directors

|

| WEDNESDAY, JUNE 2, 2021 |

| 9:00 a.m., Pacific Time |

VIRTUAL MEETING

NoticeAlphabet stockholders of 2019Class A or Class B common stock (or their proxy holders) as of the close of business on April 6, 2021 can participate in and vote at the Annual Meeting of Stockholdersby visiting www.virtualshareholdermeeting.com/GOOGL21 and entering the 16-digit control number included in your Notice, voting instruction form, or proxy card. All others may view the Annual Meeting through our Investor Relations YouTube channel at www.youtube.com/c/AlphabetIR.

Wednesday, June 19, 2019

9:00 a.m., local time

Alphabet Inc., Moffett Place Event Center (Building MP7), 1160 Bordeaux Drive, Sunnyvale, California 94089

LIVE WEBCAST

Available at https://www.youtube.com/c/AlphabetIR, starting at 9:00 a.m., local time, on Wednesday, June 19, 2019.

ITEMS OF BUSINESS

| 1. | To elect | |

| 2. | To ratify the appointment of Ernst & Young LLP as Alphabet’s independent registered public accounting firm for the fiscal year ending December 31, | |

| 3. | To approve | |

| 4. | To consider and vote upon the stockholder proposals set forth in the proxy statement, if properly presented. | |

| 5. | To consider such other business as may properly come before the meeting. |

By order of the Board of Directors,

|  | ||

| Sundar Pichai | John L. Hennessy | ||

| Chief Executive Officer | Chair of the | ||

| Board of Directors |

NOTICE

of 2021 Annual Meeting of Stockholders

ADJOURNMENTS AND POSTPONEMENTS

Any action on the items of business described abovein this Notice may be considered at the Annual Meeting at the time and on the date specified above or at any time and date to which the Annual Meeting may be properly adjourned or postponed.

RECORD DATE

You are entitled to vote only if you were a stockholder of Alphabet Class A or Class B common stock as of the close of business on April 22, 2019 (Record Date).6, 2021.

ALPHABET INC. | 2019 Proxy Statement7MEETING DETAILS

See Annual Meeting of Stockholders on page 9 of this proxy statement for details.

VOTING

Your vote is very important. Whether or not you plan to attendparticipate in the Annual Meeting, we encourage you to read this proxy statement and submit your proxy or voting instructions as soon as possible. For specific instructions on how to vote your shares, please refer to the instructions on the Notice you received in the mail, the section titled “Questions and Answers About the Proxy Materials and the Annual Meeting” beginning on page 1678 of this proxy statement or, if you requested to receive printed proxy materials, your enclosed proxy card.

April 30, 201923, 2021

By order of the Board of Directors,

| REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS: |  |

| Vote in Advance of the Meeting |  | ||||

| INTERNET |  | BY TELEPHONE |  | BY MAIL |

| Vote your shares at | Call toll-free number | Sign, date, and return your proxy | |||

| www.proxyvote.com. | 1-800-690-6903. | card in the enclosed envelope | |||

| Have your Notice, voting instruction | |||||

| form, or proxy card for the 16-digit | |||||

| control number needed to vote. | |||||

| Vote Online During the Meeting | |||||

| |||||

| See page 80 for details on voting your shares during the | |||||

This Notice of In this proxy statement, the words “Alphabet,” the “company,” “we,” “our,” “ours,” “us,” and similar terms refer to Alphabet Inc. and its consolidated subsidiaries, unless the context indicates otherwise, and the word “Google” refers to Google LLC, a wholly owned subsidiary of Alphabet. |

ALPHABET INC. | 2019 Proxy Statement8

| ALPHABET • 2021 PROXY STATEMENT | 6 |

|

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS

This proxy statement and our 20182020 Annual Report to Stockholders, which includes our Annual Report on Form 10-K for the fiscal year ended December 31, 2018, as amended,2020, are available at https://abc.xyz/investor/other/annual-meeting/.

| ALPHABET • 2021 PROXY STATEMENT | 7 |

|

INCORPORATION BY REFERENCE

To the extent that this proxy statement has been or will be specifically incorporated by reference into any other filing of Alphabet under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended (Exchange Act), the sections of this proxy statement titled “Report of the Audit and Compliance Committee of the Board of Directors” (to the extent permitted by the rules of the U.S. Securities and Exchange Commission (SEC)) and “Executive Compensation—Leadership Development and Compensation Committee Report” shall not be deemed to be so incorporated, unless specifically stated otherwise in such filing.

ALPHABET INC. | 2019 Proxy Statement9The content of any websites named, hyperlinked, or otherwise referenced in this proxy statement are not incorporated by reference into this proxy statement on Schedule 14A or in any other report or document we file with the SEC, and any references to such websites are intended to be inactive textual references only.

| ALPHABET • 2021 PROXY STATEMENT | 8 |

|

20192021 PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.THIS SUMMARY HIGHLIGHTS INFORMATION CONTAINED ELSEWHERE IN THIS PROXY STATEMENT. THIS SUMMARY DOES NOT CONTAIN ALL OF THE INFORMATION THAT YOU SHOULD CONSIDER, AND YOU SHOULD READ THE ENTIRE PROXY STATEMENT CAREFULLY BEFORE VOTING.

| — | ANNUAL MEETING OF STOCKHOLDERS |

|  |  |

| Time and Date: | Virtual Meeting Access: | Record Date: |

| 9:00 a.m., Pacific Time, on Wednesday, June 2, 2021 | Alphabet stockholders (or their proxy holders) can participate in and vote at our Annual Meeting by visiting www. virtualshareholdermeeting.com/GOOGL21 and entering the 16-digit control number included in the Notice, voting instruction form, or proxy card | April 6, 2021 |

All others may view the Annual Meeting of Stockholders

Time and Date:9:00 a.m., local time, on Wednesday, June 19, 2019.

Place:Alphabet Inc., Moffett Place Event Center (Building MP7)through our Investor Relations YouTube channel at 1160 Bordeaux Drive, Sunnyvale, CA 94089.

Record Date:April 22, 2019.www.youtube.com/c/AlphabetIR.

Voting:Holders of Class A or Class B common stock as of the Record Date are entitled to vote. Each share of Class A common stock is entitled to one (1) vote with respect to each director nominee and one (1) vote with respect to each of the proposals to be voted on. Each share of Class B common stock is entitled to ten (10) votes with respect to each director nominee and ten (10) votes with respect to each of the proposals to be voted on. The holders of the shares of Class A common stock and Class B common stock are voting as a single class on all matters. Holders of Class C capital stock have no voting power as to any items of business that will be voted on at the Annual Meeting.

Entry:Participating in the Annual Meeting: Our Annual Meeting will be accessible through the Internet only. We have adopted a virtual format for our Annual Meeting to make participation accessible for stockholders from any geographic location with internet connectivity. We have worked to offer the same participation opportunities as were provided at the in-person portion of our past meetings while further enhancing the online experience available to all stockholders regardless of their location.

You are entitled to attendparticipate in the Annual Meeting only if you were an Alphabet stockholdera holder of Class A or Class B common stock as of the close of business on the Record Date or hold a valid proxy for the Annual Meeting. If you are not a stockholder of record but hold shares through a broker, bank, trustee, or nominee (i.e., in street name), you should provide proof of beneficial ownership as of the Record Date, such as your most recent account statement prior to the Record Date, a copy of the voting instruction form provided by your broker, bank, trustee, or nominee, or similar evidence of ownership.

You should be prepared to present valid photo identification for admittance. If you do not provide photo identification or comply with the other procedures outlined above, you will notTo be admitted to the Annual Meeting. DueMeeting at www.virtualshareholdermeeting.com/GOOGL21, you must enter the 16-digit control number found in the box marked by the arrow for postal mail recipients of the Notice, voting instruction form, or the proxy card, or within the body of the email for electronic delivery recipients.

We encourage you to security measures, large bags will not be permitted, and you and your items will be subject to search prior to your admittance to the Annual Meeting. Please let us know if you plan to attendaccess the Annual Meeting by marking the appropriate box on the enclosed proxy card, if you requested to receive printed proxy materials, or, if you vote by telephone or over the Internet, by indicating your plans when prompted. Since seating is limited, admission tobefore it begins. Online check-in will start approximately 30 minutes before the Annual Meeting on June 2, 2021. If you have difficulty accessing the meeting, please call 1-844-986-0822 (toll free) or 1-303-562-9302 (international). We will be on a first-come, first-served basis.have technicians available to assist you.

If you decide to attendWe will also make the Annual Meeting in person, upon your arrival you will needviewable to register as a visitor with the registration desk locatedanyone interested through our Investor Relations YouTube channel at Moffett Place Event Center (Building MP7), 1160 Bordeaux Drive, Sunnyvale, CA 94089. See the section titled “Information Concerning Alphabet’s Annual Meeting of Stockholders” for further instructions. Check-in will begin at 7:30 a.m., local time, and you should allow ample time for the check-in procedures.www.youtube.com/c/AlphabetIR.

ALPHABET INC. | 2019 Proxy Statement10

| ALPHABET • 2021 PROXY STATEMENT | 9 |

Voting Matters

| — | VOTING MATTERS AND VOTE RECOMMENDATIONS |

| Proposal | Proposal | Alphabet Board Voting Recommendation | Page Reference (for more detail) | Proposal | Alphabet Board Voting Recommendation | Page Reference (for more detail) | ||||

| Management Proposals: | ||||||||||

| MANAGEMENT PROPOSALS: | MANAGEMENT PROPOSALS: | |||||||||

| (1) | Election of ten directors | FOReach nominee | 55 | Election of eleven directors | FOR each nominee | 53 | ||||

| (2) | Ratification of the appointment of Ernst & Young LLP as Alphabet’s independent registered public accounting firm for the fiscal year ending December 31, 2019 | FOR | 56 | Ratification of the appointment of Ernst & Young LLP as Alphabet’s independent registered public accounting firm for the fiscal year ending December 31, 2021 | FOR | 54 | ||||

| (3) | The amendment and restatement of Alphabet’s 2012 Stock Plan to increase the share reserve by 3,000,000 shares of Class C capital stock | FOR | 57 | Approval of Alphabet’s 2021 Stock Plan | FOR | 55 | ||||

| Stockholder Proposals: | ||||||||||

| STOCKHOLDER PROPOSALS: | STOCKHOLDER PROPOSALS: | |||||||||

| (4) | Stockholder proposal regarding equal shareholder voting | AGAINST | 62 | Stockholder proposal regarding equal shareholder voting | AGAINST | 61 | ||||

| (5) | Stockholder proposal regarding inequitable employment practices | AGAINST | 64 | Stockholder proposal regarding the nomination of human rights and/or civil rights expert to the board | AGAINST | 63 | ||||

| (6) | Stockholder proposal regarding the establishment of a societal risk oversight committee | AGAINST | 66 | Stockholder proposal regarding a report on sustainability metrics | AGAINST | 65 | ||||

| (7) | Stockholder proposal regarding a report on sexual harassment risk management | AGAINST | 68 | Stockholder proposal regarding a report on takedown requests | AGAINST | 67 | ||||

| (8) | Stockholder proposal regarding majority vote for the election of directors | AGAINST | 70 | Stockholder proposal regarding a report on whistleblower policies and practices | AGAINST | 69 | ||||

| (9) | Stockholder proposal regarding a report on gender pay | AGAINST | 72 | Stockholder proposal regarding a report on charitable contributions | AGAINST | 71 | ||||

| (10) | Stockholder proposal regarding strategic alternatives | AGAINST | 74 | Stockholder proposal regarding a report on risks related to anticompetitive practices | AGAINST | 73 | ||||

| (11) | Stockholder proposal regarding the nomination of an employee representative director | AGAINST | 76 | Stockholder proposal regarding a transition to a public benefit corporation | AGAINST | 75 | ||||

| (12) | Stockholder proposal regarding simple majority vote | AGAINST | 78 | |||||||

| (13) | Stockholder proposal regarding a sustainability metrics report | AGAINST | 80 | |||||||

| (14) | Stockholder proposal regarding Google Search in China | AGAINST | 82 | |||||||

| (15) | Stockholder proposal regarding a clawback policy | AGAINST | 84 | |||||||

| (16) | Stockholder proposal regarding a report on content governance | AGAINST | 86 | |||||||

| Vote in Advance of the Meeting | Vote Online During the Meeting | |||

| Vote your shares at www.proxyvote.com. Have your Notice, voting instruction form, or proxy card for the 16-digit control number needed to vote. |  | See page 80 for details on voting your shares during the Annual Meeting through www.virtualshareholdermeeting. com/GOOGL21 | |

| Call toll-free number 1-800-690-6903. | |||

| Sign, date, and return the enclosed proxy card or voting instruction form. | |||

ALPHABET INC. | 2019 Proxy Statement11

| ALPHABET • 2021 PROXY STATEMENT | 10 |

| — | CORPORATE GOVERNANCE |

We are committed to a corporate governance structure that promotes long-term stockholder value creation by providing effective leadership and Board of Directors composition while providing our stockholders with both the opportunity to provide direct feedback and key substantive rights to ensure accountability. Our Board of Directors believes that having a mix of directors with complementary qualifications, expertise, experience, and attributes is essential to meeting its oversight responsibility, representing the best interests of our stockholders, and providing practical insights and diverse perspectives.

| Effective Board Oversight | |

| Declassified Board with all members standing for election annually |

| Majority voting standard for elections of directors |

| Independent Chair of the Board, separate from Chief Executive Officer role |

| Fully independent Audit and Compliance Committee, Leadership Development and Compensation Committee, and Nominating and Corporate Governance Committee |

| Diverse Board in terms of gender, race, experience, skills, and tenure |

| Regular executive sessions of independent directors |

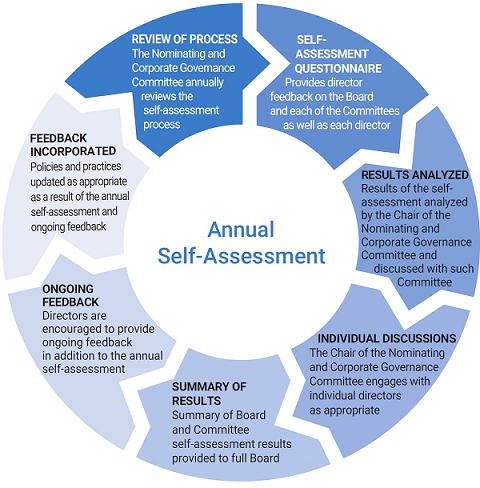

| Annual Board and Committee evaluations |

| Review of each Committee Chair at least every three years |

| Orientation and continuing education programs for directors |

| Minimum stock ownership requirements for directors and executive officers |

| ALPHABET • 2021 PROXY STATEMENT | 11 |

| — | EXECUTIVE COMPENSATION |

Director Nominees

We design our executive officer compensation programs to attract and retain the world’s best talent, support Alphabet’s culture of innovation and performance, and align employee and stockholder interests. We achieve our objectives through compensation that:

| Sound Program Design | |

| Provides a competitive total pay opportunity |

| Consists primarily of stock-based compensation, including performance stock awards with payout based on long-term company performance, aligning executives’ interests with stockholders |

| Enhances long-term focus through multi-year vesting of stock awards |

| Does not encourage unnecessary and excessive risk taking |

Our leading practices in executive compensation include:

| Best Practices in Executive Compensation | |

| Minimum stock ownership requirements |

| No excessive perquisites (no executive-only club memberships or medical benefits) |

| No employment contracts or change in control benefits |

| A policy prohibiting pledging and hedging ownership of Alphabet stock |

| No executive-only retirement programs |

| ALPHABET • 2021 PROXY STATEMENT | 12 |

| — | 2021 DIRECTOR NOMINEES |

The following table provides summary information about each director nominee as of April 25, 2019.23, 2021.

| Director | Experience/ | Membership on Standing Committees | ||||||||||||||||

| Name | Age | Since | Occupation | Qualification | Independent | AC | LDCC | NCGC | EC | |||||||||

| Larry Page | 46 | 1998 | Chief Executive Officer, Alphabet, and Co-Founder | Leadership, Technology |  | |||||||||||||

| Sergey Brin | 45 | 1998 | President, Alphabet, and Co-Founder | Leadership, Technology |  | |||||||||||||

| John L. Hennessy | 66 | 2004 | Former President of Stanford University | Leadership, Education, Technology |  |  | ||||||||||||

| L. John Doerr | 67 | 1999 | General Partner of Kleiner Perkins Caufield & Byers | Leadership, Technology, Finance, Global, Industry |  |  | ||||||||||||

| Roger W. Ferguson, Jr. | 67 | 2016 | President and Chief Executive Officer of TIAA | Leadership, Finance, Global |  |  | ||||||||||||

| Ann Mather | 59 | 2005 | Former Chief Financial Officer of Pixar | Leadership, Finance |  |  | ||||||||||||

| Alan R. Mulally | 73 | 2014 | Former Chief Executive Officer and President of Ford Motor Company | Leadership, Finance, Global, Industry |  |  | ||||||||||||

| Sundar Pichai | 46 | 2017 | Chief Executive Officer, Google | Leadership, Technology |  | |||||||||||||

| K. Ram Shriram | 62 | 1998 | Managing Partner of Sherpalo Ventures | Leadership, Technology, Global, Industry |  |  | ||||||||||||

| Robin L. Washington | 56 | 2019 | Executive Vice President and Chief Financial Officer of Gilead Sciences, Inc. | Leadership, Technology, Finance, Global, Industry |  |  | ||||||||||||

| Director | Membership on Standing Committees | |||||||||||||||

| Name | Since | Occupation | Experience/Qualification | Independent | ACC | LDCC | NCGC | EC | ||||||||

| Larry Page | 1998 | Co-Founder | Leadership, Technology, Global |  | ||||||||||||

| Sergey Brin | 1998 | Co-Founder | Leadership, Technology, Global |  | ||||||||||||

| Sundar Pichai | 2017 | Chief Executive Officer, Alphabet and Google | Leadership, Technology, Global |  | ||||||||||||

| John L. Hennessy† | 2004 | Former President of Stanford University | Leadership, Education, Technology |  |  | |||||||||||

| Frances H. Arnold | 2019 | Linus Pauling Professor of Chemical Engineering, Bioengineering and Biochemistry at California Institute of Technology | Leadership, Education, Science |  |  | |||||||||||

| L. John Doerr | 1999 | General Partner and Chairman of Kleiner Perkins | Leadership, Technology, Finance, Global, Industry |  |  | |||||||||||

| Roger W. Ferguson Jr. | 2016 | President and Chief Executive Officer of TIAA(1) | Leadership, Finance, Global |  |  | |||||||||||

| Ann Mather | 2005 | Former Executive Vice President and Chief Financial Officer of Pixar | Leadership, Finance, Global |  |   | |||||||||||

| Alan R. Mulally | 2014 | Former Chief Executive Officer and President of Ford Motor Company | Leadership, Finance, Global, Industry |  |  | |||||||||||

| K. Ram Shriram | 1998 | Managing Partner of Sherpalo Ventures | Leadership, Technology, Finance, Global, Industry |  |  | |||||||||||

| Robin L. Washington | 2019 | Former Executive Vice President and Chief Financial Officer of Gilead Sciences | Leadership, Technology, Finance, Global, Industry |  |  | |||||||||||

| ACC | Audit and Compliance Committee |

| LDCC | Leadership Development and Compensation Committee |

| NCGC | Nominating and Corporate Governance Committee |

| EC | Executive Committee |

| Committee |

| Audit Committee Financial Expert |

| |

| (1) | Roger has announced his plan to retire as President and Chief Executive Officer of TIAA effective May 2021 |

Each director nominee serves as a current director and attended at least 75% of all meetings of the Board of Directors and each committee on which she or he sat during 2018.

Auditors

| — | AUDITORS |

We are asking our stockholders to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019.2021. Set forth below is summary information with respect to the fees paid or accrued by us for the audit and other services provided by Ernst & Young LLP during 20172019 and 20182020 (in thousands).

| 2017 ($) | 2018 ($) | 2019 ($) | 2020 ($) | |||||||

| Audit Fees | 16,742 | 16,072 | 20,112 | 21,718 | ||||||

| Audit-Related Fees | 4,365 | 6,232 | 7,185 | 6,652 | ||||||

| Tax Fees | 4,547 | 4,377 | 1,944 | 988 | ||||||

| Other Fees | 334 | 764 | 608 | 1,871 | ||||||

| Total Fees | 25,988 | 27,445 | ||||||||

| TOTAL FEES | 29,848 | 31,229 | ||||||||

ALPHABET INC. | 2019 Proxy Statement12

| ALPHABET • 2021 PROXY STATEMENT | 13 |

| ALPHABET • 2021 PROXY STATEMENT | 14 |

ALPHABET INC. | 2019 Proxy Statement13

| ALPHABET • 2021 PROXY STATEMENT | 15 |

DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE

ALPHABET INC. | 2019 Proxy Statement14

Corporate Governance Highlights

Our Board of Directors is composed of highly experienced directors who have led, advised, and established leading global organizations and institutions. Our Board of Directors has taken a thoughtful approach to board composition to ensure that our directors have backgrounds that collectively add significant value to the strategic decisions made by the company and that enable them to provide oversight of management to ensure accountability to our stockholders. Our directors have extensive backgrounds as entrepreneurs, technologists, operational and financial experts, academics, scientists, investors, advisors, nonprofit board members, and government leaders. In addition, we have worked hard to strike the right balance between long-term understanding of our business and fresh external perspectives, adding three new directors in the past five years, as well as to ensure diversity of backgrounds and perspectives within the boardroom.

Our Director Nominees

| ALPHABET • 2021 PROXY STATEMENT | 16 |

ALPHABET INC.

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

Our Board of Directors has made these materials available to you on the Internet, or, upon your request, has delivered printed proxy materials to you, in connection with the solicitation of proxies for use at Alphabet’s 2019 Annual Meeting of Stockholders (Annual Meeting), which will take place on Wednesday, June 19, 2019 at 9:00 a.m., local time, at Moffett Place Event Center (Building MP7) at 1160 Bordeaux Drive, Sunnyvale, California 94089. You are invited to attend the Annual Meeting if you were an Alphabet stockholder as of the close of business on April 22, 2019, the Record Date for the Annual Meeting, or hold a valid proxy for the Annual Meeting. If you are a holder of Alphabet Class A or Class B common stock as of the Record Date, you are requested to vote on the items of business described in this proxy statement. This proxy statement includes information that we are required to provide to you under the SEC rules and that is designed to assist you in voting your shares.

The proxy materials include:

and Stockholder Proposals | |

Answers |

The information in this proxy statement relates to the proposals to be voted on at the Annual Meeting, the voting process, the compensation of our directors and certain of our executive officers, corporate governance, and certain other required information.

In accordance with rules adopted by the SEC, we may furnish proxy materials, including this proxy statement and our Annual Report, to our stockholders by providing access to such documents on the Internet instead of mailing printed copies. Most stockholders will not receive printed copies of the proxy materials unless they request them. Instead, the Notice, which was mailed to the holders of Class A and Class B common stock, will instruct you as to how you may access and review all of the proxy materials on the Internet. The Notice also instructs you as to how you may submit your proxy on the Internet. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials in the Notice.

We have adopted a procedure called “householding,” which the SEC has approved. Under this procedure, we deliver a single copy of the Notice and, if applicable, the proxy materials to multiple stockholders who share the same address unless we receive contrary instructions from one or more of the stockholders. This procedure reduces our printing costs, mailing costs, and fees. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written request, we will

ALPHABET INC. | 2019 Proxy Statement 16

deliver promptly a separate copy of the Notice and, if applicable, the proxy materials to any stockholder at a shared address to which we delivered a single copy of any of these documents. To receive a separate copy of the Notice and, if applicable, the proxy materials, stockholders may contact us as follows:

|  |  |

|

Stockholders who hold shares in street name (as described on page 18) may contact their brokerage firm, bank, broker-dealer, or other similar organization to request information about householding.

The Notice, proxy card, or voting instruction form will contain instructions on how to:

Our proxy materials are also available on our Investor Relations website at https://abc.xyz/investor/other/annual-meeting/.

Choosing to receive your future proxy materials by email will save us the cost of printing and mailing documents to you, and will reduce the impact of printing and mailing these materials on the environment. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you revoke it.

The items of business scheduled to be voted on at the Annual Meeting are set forth beginning on page 55 of this proxy statement. We will also consider any other business that properly comes before the Annual Meeting. See Question 21.

Our Board of Directors recommends that you vote your shares “FOR” each of the director nominees, “FOR” Proposals Number 2 and Number 3, and “AGAINST” Proposals Number 4 through Number 16.

Each share of Alphabet Class A common stock and Class B common stock issued and outstanding as of the close of business on April 22, 2019, the Record Date for the Annual Meeting, is entitled to be voted on all items being voted on at the Annual Meeting. Holders of Alphabet Class C capital stock have no voting power as to any items of business that will be voted on at the Annual Meeting. You may vote all shares of Alphabet Class A common stock and Class B common stock that you owned as of the Record Date, including shares held: (1) directly in your name as the stockholder of record, and (2) for you as the beneficial owner in street name through a broker, bank, trustee, or other nominee. On the Record Date, we had 345,980,307 shares of Class A common stock and Class B common stock issued and outstanding, consisting of 299,436,023 shares of Class A common stock and 46,544,284 shares of Class B common stock. On the Record Date, we had 348,263,508 shares of Class C capital stock issued and outstanding.

ALPHABET INC. | 2019 Proxy Statement 17

Each holder of shares of Alphabet Class A common stock is entitled to one (1) vote for each share of Class A common stock held as of the Record Date, and each holder of shares of Alphabet Class B common stock is entitled to ten (10) votes for each share of Class B common stock held as of the Record Date. The holders of the shares of Alphabet Class A common stock and Class B common stock are voting as a single class on all matters described in this proxy statement for which your vote is being solicited.

Most Alphabet stockholders hold their shares as a beneficial owner through a broker or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

You may vote your shares held in your name as the stockholder of record in person at the Annual Meeting. You may vote your shares held beneficially in street name in person at the Annual Meeting only if you obtain a legal proxy from the broker, bank, trustee, or nominee that holds your shares giving you the right to vote the shares. Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions as described below so that your vote will be counted if you later decide not to attend the Annual Meeting.

Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct how your shares are voted without attending the Annual Meeting.

If you are a stockholder of record, you may vote by proxy over the Internet by following the instructions provided in the Notice, or, if you requested to receive printed proxy materials, you can also vote by mail or telephone pursuant to instructions provided on the proxy card.

If you hold shares beneficially in street name, you may also vote by proxy over the Internet by following the instructions provided in the Notice, or, if you requested to receive printed proxy materials, you can also vote by telephone or mail by following the voting instruction form provided to you by your broker, bank, trustee, or nominee.

ALPHABET INC. | 2019 Proxy Statement 18

If you are the stockholder of record, you may change your vote at any time prior to the taking of the vote at the Annual Meeting by:

If you hold shares beneficially in street name, you may change your vote at any time prior to the taking of the vote at the Annual Meeting by:

Note that for both stockholders of record and beneficial owners, attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically so request or vote in person at the Annual Meeting.

Proxy instructions, ballots, and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within Alphabet or to third parties, except: (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote, and (3) to facilitate a successful proxy solicitation. Occasionally, stockholders provide on their proxy card written comments, which are then forwarded to Alphabet management.

The quorum requirement for holding the Annual Meeting and transacting business is that holders of a majority of the voting power of Alphabet’s shares of Class A common stock and Class B common stock outstanding as of the Record Date must be present in person or represented by proxy. Both abstentions and broker non-votes (described on page 20) are counted for the purpose of determining the presence of a quorum.

In the election of directors (Proposal Number 1), you may vote “FOR” all or some of the nominees or your vote may be “WITHHELD” with respect to one or more of the nominees.

For the other items of business, you may vote “FOR,” “AGAINST,” or “ABSTAIN.” If you elect to “ABSTAIN,” the abstention has the same effect as a vote “AGAINST.”

If you provide specific instructions with regard to certain items, your shares will be voted as you instruct on such items. If no instructions are indicated on a properly executed proxy card or over the telephone or Internet, the shares will be voted as recommended by our Board of Directors.

In the election of directors, the ten persons receiving the highest number of affirmative “FOR” votes at the Annual Meeting will be elected.

The approval of the remaining fifteen proposals in each case requires the affirmative “FOR” vote of the holders of a majority of the voting power of Alphabet’s shares of Class A common stock and Class B common stock present in person or represented by proxy at the Annual Meeting and entitled to vote thereon, voting together as a single class.

ALPHABET INC. | 2019 Proxy Statement 19

If you hold shares beneficially in street name and do not provide your broker with voting instructions, your shares may constitute “broker non-votes.” Broker non-votes occur on a matter when a broker is not permitted to vote on that matter without instructions from the beneficial owner and instructions are not given. These matters are referred to as “non-routine” matters. All of the matters scheduled to be voted on at the Annual Meeting are “non-routine,” except for the proposal to ratify the appointment of Ernst & Young LLP as Alphabet’s independent registered public accounting firm for the fiscal year ending December 31, 2019. In tabulating the voting result for any particular proposal, shares that constitute broker non-votes are not considered voting power present with respect to that proposal. Thus, broker non-votes will not affect the outcome of any matter being voted on at the Annual Meeting, assuming that a quorum is obtained.

Abstentions are considered voting power present at the Annual Meeting and thus will have the same effect as votes against each of the matters scheduled to be voted on at the Annual Meeting (other than the election of directors).

Please note that since brokers may not vote your shares on “non-routine” matters, including the election of directors (Proposal Number 1), the proposal to amend and restate Alphabet’s 2012 Stock Plan (Proposal Number 3), and each of the stockholder proposals (Proposals Number 4 through Number 16), in the absence of your specific instructions, we encourage you to provide instructions to your broker regarding the voting of your shares.

No, you may not cumulate your votes for the election of directors.

Alphabet is making this solicitation and will pay the entire cost of preparing, assembling, printing, mailing, and distributing these proxy materials and soliciting votes. If you choose to access the proxy materials and/or vote over the Internet, you are responsible for internet access charges you may incur. If you choose to vote by telephone, you are responsible for telephone charges you may incur. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone, or by electronic communication by our directors, officers, and employees, who will not receive any additional compensation for such solicitation activities. We have also retained Georgeson LLC to assist us in the distribution of proxy materials. We will pay Georgeson LLC a fee of approximately $1,200 plus reasonable out-of-pocket expenses for these services.

In addition to the sixteen items of business described in this proxy statement, a certain stockholder has provided notice of his intent to present a proposal at the Annual Meeting regarding Alphabet’s compliance with sanctions programs administered by the United States Office of Foreign Assets Control. The persons named as proxy holders, Larry Page, Ruth M. Porat, David C. Drummond, Kent Walker, and Kathryn W. Hall, or any of them, have discretionary authority in voting the proxies under Rule 14a-4(c) under the Exchange Act and intend to exercise such discretion to vote “AGAINST” such proposal if presented at the Annual Meeting.

Other than the above, we are not aware of any other business to be acted upon at the Annual Meeting. If you grant a proxy, the persons named as proxy holders, Larry Page, Ruth M. Porat, David C. Drummond, Kent Walker, and Kathryn W. Hall, or any of them, will have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting. If, for any reason, any of the nominees is not available as a candidate for director, the persons named as proxy holders will vote your proxy for such other candidate or candidates as may be nominated by the Board of Directors.

We will announce preliminary voting results at the Annual Meeting and publish final voting results on the Investor Relations section of our website at https://abc.xyz/investor/other/annual-meeting/. We will also disclose the final voting results in a Current Report on Form 8-K filed with the SEC within four business days of the Annual Meeting.

ALPHABET INC. | 2019 Proxy Statement 20

You are entitled to attend the Annual Meeting if you were a holder of Alphabet Class A or Class B common stock as of the Record Date or you hold a valid proxy for the Annual Meeting. Since seating is limited, admission to the Annual Meeting will be on a first-come, first-served basis. You must present valid photo identification, such as a driver’s license or passport, for admittance. If you are not a stockholder of record but hold shares as a beneficial owner in street name, you must also provide proof of beneficial ownership as of the Record Date, such as your most recent account statement prior to April 22, 2019, a copy of the voting instruction form provided by your broker, bank, trustee, or nominee, or other similar evidence of ownership.

If you do not provide photo identification or comply with the other procedures outlined above, you will not be admitted to the Annual Meeting. Due to security measures, large bags and packages will not be permitted, and you and your items will be subject to search prior to your admittance to the Annual Meeting.

Please let us know if you plan to attend the Annual Meeting by marking the appropriate box on the enclosed proxy card, if you requested to receive printed proxy materials, or, if you vote by telephone or Internet, by indicating your plans when prompted.

The Annual Meeting will begin promptly at 9:00 a.m., local time. Check-in will begin at Moffett Place Event Center (Building MP7) at 1160 Bordeaux Drive, Sunnyvale, CA 94089 at 7:30 a.m., local time, and you should allow ample time for the check-in procedures.

For your convenience, we are pleased to offer a live webcast of our Annual Meeting at https://www.youtube.com/c/AlphabetIR.

The inspector of elections will be a representative from Computershare.

Contact our transfer agent by either writing to Computershare Investor Services, P.O. Box 505000, Louisville, KY 40233-5000 (courier services should be sent to Computershare Investor Services, 462 South 4thStreet, Suite 1600, Louisville, KY 40202-3467), by telephoning shareholder services 1-866-298-8535 (toll free within the USA, US territories and Canada), or 1-781-575-2879 or by visiting Investor Centre™ portal at www.computershare.com/investor.

Stockholder Proposals, Director Nominations, and Related Bylaw Provisions

Stockholder Proposals:Stockholders may present proper proposals for inclusion in our proxy statement and for consideration at the 2020 Annual Meeting of Stockholders by submitting their proposals in writing to Alphabet’s Corporate Secretary in a timely manner. For a stockholder proposal to be considered timely for inclusion in our proxy statement for our 2020 Annual Meeting of Stockholders, the Corporate Secretary of Alphabet must receive the written proposal at our principal executive offices or at the email address set

ALPHABET INC. | 2019 Proxy Statement 21

forth below no later than January 1, 2020. If we hold our 2020 Annual Meeting of Stockholders more than 30 days before or after June 19, 2020 (the one-year anniversary date of the 2019 Annual Meeting of Stockholders), we will disclose the new deadline by which stockholder proposals must be received under Item 5 of Part II of our earliest possible Quarterly Report on Form 10-Q or, if impracticable, by any means reasonably determined to inform stockholders. In addition, stockholder proposals must otherwise comply with the requirements of Rule 14a-8 under the Exchange Act and with the SEC regulations under Rule 14a-8 regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Proposals should be addressed in one of the following two ways:

| 1. | via mail with a copy via email: | 2. | via email only: | |||||

| Alphabet Inc. Attn: Corporate Secretary 1600 Amphitheatre Parkway Mountain View, California 94043 |  | With a copy via email: corporatesecretary@abc.xyz

| OR |  | corporatesecretary@abc.xyz | ||

Our bylaws also establish an advance notice procedure for stockholders who wish to present a proposal before an annual meeting of stockholders but do not intend for the proposal to be included in our proxy statement. Our bylaws provide that the only business that may be conducted at an annual meeting is business that is: (1) specified in the notice of a meeting given by or at the direction of our Board of Directors, (2) otherwise properly brought before the meeting by or at the direction of our Board of Directors, or (3) properly brought before the meeting by a stockholder entitled to vote at the annual meeting who has delivered timely written notice to our Corporate Secretary, which notice must contain the information specified in our bylaws. To be timely for our 2020 Annual Meeting of Stockholders, our Corporate Secretary must receive the written notice at our principal executive offices and/or at the email address set forth above:

If we hold our 2020 Annual Meeting of Stockholders more than 30 days before or after June 19, 2020 (the one-year anniversary date of the 2019 Annual Meeting of Stockholders), the notice of a stockholder proposal that is not intended to be included in our proxy statement must be received not later than the close of business on the earlier of the following two dates:

If a stockholder who has notified us of his or her intention to present a proposal at an annual meeting does not appear to present his or her proposal at such meeting, we are not required to present the proposal for a vote at such meeting.

Nomination of Director Candidates:You may propose director candidates for consideration by our Nominating and Corporate Governance Committee. Any such recommendations should include the nominee’s name and qualifications for membership on our Board of Directors, and should be directed to the Corporate Secretary of Alphabet at the mailing and/or email address set forth above. For additional information regarding stockholder recommendations for director candidates, see “Directors, Executive Officers, and Corporate Governance—Corporate Governance and Board Matters—Consideration of Director Nominees—Stockholder Recommendations and Nominees” on page 30 of this proxy statement.

In addition, our bylaws permit stockholders to nominate directors for election at an annual meeting of stockholders. To nominate a director, the stockholder must provide the information required by our bylaws. In addition, the stockholder must give timely notice to our Corporate Secretary in accordance with the advance notice procedure set forth in our bylaws, which, in general, require that our Corporate Secretary receive the notice within the time period described above under “Stockholder Proposals” for stockholder proposals that are not intended to be included in our proxy statement.

Copy of Bylaw Provisions:A copy of our bylaws is available at https://abc.xyz/investor/other/bylaws/. You may also contact our Corporate Secretary at our principal executive offices for a copy of the relevant bylaw provisions regarding the requirements for submitting stockholder proposals and nominating director candidates.

ALPHABET INC. | 2019 Proxy Statement 22

DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE

Directors and Executive Officers

The names of our directors and executive officers and their ages, positions, and biographies as of April 25, 201923, 2021 are set forth below. Our executive officers are appointed by and serve at the discretion of ourthe Board of Directors. There are no family relationships among any of our directors or executive officers.

| Name | Age | Position | ||

| Larry Page | Co-Founder and Director | |||

| Sergey Brin | Co-Founder and Director | |||

| Sundar Pichai | 48 | Chief Executive Officer, Alphabet | ||

| John L. Hennessy | Chair of the Board | |||

| Frances H. Arnold | 64 | Director | ||

| L. John Doerr | 69 | Director | ||

| Roger W. Ferguson Jr. | 69 | Director | ||

| Ann Mather | 61 | Director | ||

| Alan R. Mulally | ||||

| K. Ram Shriram | 64 | Director | ||

| Robin L. Washington | 58 | Director | ||

| Ruth M. Porat | 63 | Senior Vice President, and Chief Financial Officer, Alphabet and Google | ||

| Prabhakar Raghavan | 60 | Senior Vice President, Google | ||

| Philipp Schindler | 50 | Senior Vice President, Chief Business Officer, Google | ||

| Kent Walker | 60 | Senior Vice President, Global Affairs, and Chief Legal Officer, Google; Corporate Secretary, Alphabet |

Larry Page

Director Since

| LARRY PAGE | |

Director Co-Founder | Larry Page is one of Google’s Co-Founders and has served as a member of our Board of Directors since its inception in September 1998. Larry previously served as Google’s Chief Executive Officer from April 2011 to October 2015, and as Alphabet’s Chief Executive Officer from October 2015 to December 2019. From July 2001 to April 2011, Larry served as Google’s President, Products. In addition, from September 1998 to July 2001, Larry served as Google’s Chief Executive Officer, and from September 1998 to July 2002, as Google’s Chief Financial Officer. Larry holds a Bachelor of Science degree in engineering, with a concentration in computer engineering, from the University of Michigan and a Master of Science degree in computer science from Stanford University. |

| SERGEY BRIN | |

Director Co-Founder | Sergey Brin is one of Google’s Co-Founders and has served as a member of our Board of Directors since its inception in September 1998. Sergey previously served as Google’s President from May 2011 to October 2015, and as Alphabet’s President from October 2015 to December 2019. From July 2001 to April 2011, Sergey served as Google’s President, Technology and Co-Founder. In addition, from September 1998 to July 2001, Sergey served as Google’s President and Chairman of Google’s Board of Directors. Sergey holds a Bachelor of Science degree with high honors in mathematics and computer science from the University of Maryland at College Park and a Master of Science degree in computer science from Stanford University. |

Larry Page, Chief Executive Officer of Alphabet, was one of Google’s Founders and has served as a member of our Board of Directors since its inception in September 1998, and as Google’s Chief Executive Officer from April 2011 to October 2015 (when he became the Chief Executive Officer of Alphabet). From July 2001 to April 2011, Larry served as Google’s President, Products. In addition, from September 1998 to July 2001, Larry served as Google’s Chief Executive Officer, and from September 1998 to July 2002, as Google’s Chief Financial Officer. Larry holds a Master of Science degree in computer science from Stanford University and a Bachelor of Science degree in engineering, with a concentration in computer engineering, from the University of Michigan.

Sergey Brin

Director Since 1998

Sergey Brin, President of Alphabet, was one of Google’s Founders and has served as a member of our Board of Directors since its inception in September 1998. Previously, Sergey served as Google’s President, Technology and Co-Founder. In addition, from September 1998 to July 2001, Sergey served as Google’s President and Chairman of Google’s Board of Directors. Sergey holds a Master of Science degree in computer science from Stanford University and a Bachelor of Science degree with high honors in mathematics and computer science from the University of Maryland at College Park.

John L. Hennessy

Director Since 2004

John L. Hennessyhas served as a member of our Board of Directors since April 2004 and as Chairman of the Board of Directors since January 2018. John previously served as our Lead Independent Director from April 2007 to January 2018. John served as the President of Stanford University from September 2000 to August 2016. John was previously a director and a member of the nominating and governance committee and acquisition committee of Cisco Systems, Inc., a networking equipment company, from January 2002 to December 2018. He also serves as a trustee of the Gordon and Betty Moore Foundation and as a director of the Chan Zuckerberg Biohub. From 1994 to August 2000, John held various positions at Stanford, including Dean of the Stanford University School of Engineering and Chair of the Stanford University Department of Computer Science. John holds a Doctoral degree and a Master of Science degree in computer science from the State University of New York, Stony Brook, and a Bachelor of Science degree in electrical engineering from Villanova University.

ALPHABET INC. | 2019 Proxy Statement 23

| ALPHABET • 2021 PROXY STATEMENT | 17 |

L. John Doerr

Director Since 1999

| 1 | Corporate Governance | 2 | Director and Executive Compensation | 3 | Audit Matters | 4 | Management and Stockholder Proposals | 5 | Questions and Answers |

L. John Doerrhas served as a member of our Board of Directors since May 1999. John has been a General Partner of Kleiner Perkins Caufield & Byers, a venture capital firm, since August 1980. John has also been a member of the board of directors of Amyris, Inc., a renewable products company, since May 2006, and serves as chair of its nominating and governance committee, and Bloom Energy Corporation, a clean energy company, since May 2002, and serves as its lead independent director and a member of the compensation and organization development committee. John was previously a director of Zynga, Inc., a provider of social game services, from April 2013 to May 2017. John holds a Master of Business Administration degree from Harvard Business School, and a Master of Science degree in electrical engineering and computer science, and a Bachelor of Science degree in electrical engineering from Rice University.

| SUNDAR PICHAI | |

Director Chief Executive | Sundar Pichai, Chief Executive Officer of Alphabet since December 2019 and Google since October 2015, has served as a member of our Board of Directors since July 2017. Sundar previously served as Google’s Senior Vice President of Products from October 2014 to October 2015, and as Google’s Senior Vice President of Android, Chrome and Apps from March 2013 to October 2014. Since joining Google in April 2004, Sundar has held various positions, including Google’s Senior Vice President, Chrome and Apps; Senior Vice President, Chrome; and Vice President, Product Management. Prior to joining Google, Sundar worked in engineering and product management at Applied Materials, Inc., a semiconductor company, and in management consulting at McKinsey & Company, a management consulting firm. Sundar holds a Bachelor of Engineering degree with honors in metallurgical engineering from the Indian Institute of Technology Kharagpur, a Master of Science degree in materials science and engineering from Stanford University, and a Master of Business Administration degree from The Wharton School of the University of Pennsylvania. |

| JOHN L. HENNESSY | |

| Director since: 2004 | John L. Hennessy has served as a member of our Board of Directors since April 2004 and as Chair of the Board of Directors since January 2018. John previously served as our Lead Independent Director from April 2007 to January 2018. John is the James F. and Mary Lynn Gibbons Professor of Computer Science and Electrical Engineering in the Stanford School of Engineering, and the Shriram Family Director of Stanford’s Knight-Hennessy Scholars, a graduate-level scholarship program. John served as the President of Stanford University from September 2000 to August 2016. From 1994 to August 2000, John held various positions at Stanford, including Dean of the Stanford University School of Engineering and Chair of the Stanford University Department of Computer Science. John was previously a director and a member of the nominating and governance committee and acquisition committee of Cisco Systems, Inc., a networking equipment company, from January 2002 to December 2018. He also serves as a trustee of the Gordon and Betty Moore Foundation and as a director of the Chan Zuckerberg Biohub. John holds a Bachelor of Science degree in electrical engineering from Villanova University and a Master of Science degree and a Doctoral degree in computer science from the State University of New York, Stony Brook. |

| FRANCES H. ARNOLD | |

| Director since: 2019 | Frances H. Arnold has served as a member of our Board of Directors since December 2019. Frances manages a research group, is the Linus Pauling Professor of Chemical Engineering, Bioengineering and Biochemistry, and is a Director of the Donna and Benjamin M. Rosen Bioengineering Center, all at the California Institute of Technology. She joined the California Institute of Technology in 1986 and has served as a Visiting Associate, Assistant Professor, Professor, and Director. Frances’s laboratory focuses on protein engineering by directed evolution, with applications in alternative energy, chemicals, and medicine. She has been appointed co-chair of the President’s Council of Advisors on Science & Technology by President Biden. Frances is the recipient of numerous honors, including the Nobel Prize in Chemistry, the Millennium Technology Prize, induction into the National Inventors Hall of Fame, Fellow of the National Academy of Inventors, the ENI Prize in Renewable and Nonconventional Energy, the U.S. National Medal of Technology and Innovation, and the Charles Stark Draper Prize of the U.S. National Academy of Engineering. Frances is an elected member of all three U.S. National Academies of Science, Medicine, and Engineering, as well as the American Academy of Arts and Sciences. Frances has been a member of the board of directors of Illumina, Inc., a provider of integrated systems for the analysis of genetic variation and biological function, since 2016, and serves as chair of its science and technology committee and as a member of the nominating and corporate governance committee. Frances holds a Bachelor of Science degree in mechanical and aerospace engineering from Princeton University and a Doctoral degree in chemical engineering from the University of California, Berkeley. |

Roger W. Ferguson, Jr.

Director Since 2016

Roger W. Ferguson, Jr. has served as a member of our Board of Directors since June 2016. Roger has served as the President and Chief Executive Officer of TIAA, a major financial services company, since April 2008. He joined TIAA after his tenure at Swiss Re, a global reinsurance company, where he served as Chairman of the firm’s America Holding Corporation, Head of Financial Services, and a member of the Executive Committee from 2006 to 2008. Prior to that, Roger joined the Board of Governors of the U.S. Federal Reserve System in 1997 and served as its Vice Chairman from 1999 to 2006. From 1984 to 1997, he was an associate and partner at McKinsey & Company. Roger has been a member of the board of directors of General Mills, Inc., a manufacturer and marketer of branded consumer foods, since December 2015, and serves as chair of its finance committee and as a member of its corporate governance committee; and a member of the board of directors of International Flavors & Fragrances, Inc., a creator of flavors and fragrances, since April 2010, and serves as chair of its compensation committee. Roger is also a member of the Smithsonian Institution’s Board of Regents and serves on the New York State Insurance Advisory Board. He is a fellow of the American Academy of Arts & Sciences and co-chairs its Commission on the Future of Undergraduate Education. He is currently Chairman of the Conference Board and serves on the boards of the American Council of Life Insurers, the Institute for Advanced Study, and the Memorial Sloan Kettering Cancer Center. He is a fellow of the American Philosophical Society and a member of the Economic Club of New York, the Council on Foreign Relations, and the Group of Thirty. Roger holds a Bachelor of Arts degree in economics, a Doctoral degree in economics, and a Juris Doctor degree, all from Harvard University.

Diane B. Greene

Director Since 2012

Diane B. Greenehas served as a member of our Board of Directors since January 2012 and served as a Senior Vice President, Google, Chief Executive Officer for Google Cloud, from December 2015 to January 2019. Diane founded bebop Technologies, Inc. (bebop) and served as Chief Executive Officer and a member of its board of directors from December 2012 to December 2015 when bebop was acquired by Google. Diane was previously a director of Intuit Inc., a provider of business and financial management solutions, from August 2006 to January 2018. Diane co-founded VMware, Inc., a virtualization software company, in 1998 and took the company public in 2007. She served as Chief Executive Officer and President of VMware from 1998 to 2008, as a member of the board of directors of VMware from 2007 to 2008, and as an Executive Vice President of EMC Corporation, a provider of information infrastructure and virtual infrastructure technologies, solutions and services, from 2005 to 2008. Prior to VMware, Diane held technical leadership positions at Silicon Graphics Inc., a provider of technical computing, storage and data center solutions, Tandem Computers, Inc., a manufacturer of computer systems, and Sybase Inc., an enterprise software and services company, and was Chief Executive Officer of VXtreme, Inc., a developer of streaming media solutions. Diane has been a member of the Supervisory Board of SAP SE, an enterprise application software company, since March 2018. Diane is also a lifetime member of The MIT Corporation, the governing body of the Massachusetts Institute of Technology. She is also a member of the National Academy of Engineering. Diane holds a Master of Science degree in computer science from the University of California, Berkeley, a Master of Science degree in naval architecture from the Massachusetts Institute of Technology, and a Bachelor of Arts degree in mechanical engineering and an honorary doctorate from the University of Vermont.

Ann Mather

Director Since 2005

Ann Matherhas served as a member of our Board of Directors since November 2005. Ann has more than 20 years of experience serving as a finance executive in a number of technology companies, particularly public companies, overseeing and assessing company performance. Ann has also been a member of the board of directors of: Arista Networks, Inc., a computer networking company, since June 2013, and serves as chair of its audit committee; Glu Mobile Inc., a publisher of mobile games, since September 2005, and serves on its nominating and corporate governance committee; Netflix, Inc., a streaming media company, since July 2010, and serves as chair of its audit committee; and Shutterfly, Inc., an internet-based image publishing company, since May 2013. Ann has also been an independent trustee to the Dodge & Cox Funds board of trustees since May 2011. From 1999 to 2004, Ann was Executive Vice President and Chief Financial Officer of Pixar, a computer animation film studio. Prior to her service at Pixar, Ann was Executive Vice President and Chief Financial Officer of Village Roadshow Pictures, the film production division of Village Roadshow Limited. Ann holds a Master of Arts degree from Cambridge University in England, is an honorary fellow of Sidney Sussex College, Cambridge, and is a chartered accountant.

ALPHABET INC. | 2019 Proxy Statement 24

| ALPHABET • 2021 PROXY STATEMENT | 18 |

Alan R. Mulally

Director Since 2014

| 1 | Corporate Governance | 2 | Director and Executive Compensation | 3 | Audit Matters | 4 | Management and Stockholder Proposals | 5 | Questions and Answers |

Alan R. Mulallyhas served as a member of our Board of Directors since July 2014. Alan served as President and Chief Executive Officer of Ford Motor Company, a global automotive company, from September 2006 through June 2014. Alan was previously a member of the board of directors of Ford and served on its finance committee from September 2006 through June 2014. From March 2001 to September 2006, Alan served as Executive Vice President of the Boeing Company and President and Chief Executive Officer of Boeing Commercial Airplanes, Inc. He also was a member of the Boeing Executive Council. Prior to that time, he served as President of Boeing’s space and defense business. Alan served as co-chair of the Washington Competitiveness Council and sat on the advisory boards of NASA, the University of Washington, the University of Kansas, the Massachusetts Institute of Technology, and the U.S. Air Force Scientific Advisory Board. He is a member of the U.S. National Academy of Engineering and a fellow of England’s Royal Academy of Engineering. Alan holds a Bachelor of Science and Master of Science degrees in aeronautical and astronautical engineering from the University of Kansas, and a Master’s degree in Management from the Massachusetts Institute of Technology as a 1982 Alfred P. Sloan fellow.

| L. JOHN DOERR | |

| Director since: 1999 | L. John Doerr has served as a member of our Board of Directors since May 1999. John has been a General Partner of Kleiner Perkins, a venture capital firm, since August 1980. John has been a member of the board of directors of Amyris, Inc., a renewable products company, since May 2006, and serves as chair of its nominating and governance committee; Coursera Inc., a provider of learning platform, since December 2011, and serves on its nominating and corporate governance committee; DoorDash, Inc., a logistics platform company, since March 2015, and serves as chair of its nominating and governance committee; and QuantumScape Corporation, a breakthrough battery company, since December 2010, and serves as chair of its nominating and governance committee. John was previously a director of Bloom Energy Corporation, a green energy company, from May 2002 to April 2021, and a director of Zynga, Inc., a provider of social game services, from April 2013 to May 2017. John holds a Bachelor of Science degree in electrical engineering, a Master of Science degree in electrical engineering from Rice University, and a Master of Business Administration degree from Harvard Business School. |

| ROGER W. FERGUSON JR. | |